Owen Luder: Practice at Work

The day-to-day workings of a practice such as OLP fall into two separate yet overlapping sectors: administration and job organisation. Unless these two are properly related and maintained, no amount of design talent, no amount of entrepreneurial vigour or personal charm will keep the practice alive and flourishing. For, despite the thousands of words written about the art of architecture, the hard truth is that little of that art would see the light of day without the solid businesslike foundation common to all successful commercial undertakings. Of course there are and always will be some architects who regard this characteristic as being incompatible with ‘Architecture’. Sadly, this is a view still encouraged in too many schools of architecture where such eccentricity is seen not as a solipsistic fault but as an indication of genuine talent. Extend this view to cover a practice of about fifty people needing annual fees of, say, £500,000 in order to keep afloat and it becomes obvious, as the OP partners agree, that the right way of running a practice is of cardinal importance. The right way – stability and profitability, the wrong way – financial disaster. For this reason, they argue, it is imperative that all the partners in a practice must have, as well as design skills, a broad appreciation of the general business rules for operating a practice. It is all very well to suggest employing experts to deal with notoriously difficult subjects such as taxation but it is no use doing so unless the recipients of the advice given have enough general knowledge themselves to understand whether the advice makes sense or not and how it should be interpreted. In the end the partners have to make the decisions – not the experts who may advise them.

In 1973 Owen Luder wrote an article for the RIBA Journal on the financial management of a practice in which he projected the x3 principle on which his practice had operated since its earliest days. As a rule of thumb, total fee divided by three should give the total technical staff-time cost that could be allocated to a job so that in general terms it remains profitable. Another third would represent overheads, the final third ‘gross profit’, which includes partners’ salaries, tax and similar items as well as net profit. This formula as a broad assessment has rarely failed – interpreted sensibly it has given advance warning of trouble at all levels of the office operation – individual staff, jobs, offices and overall practice performance.

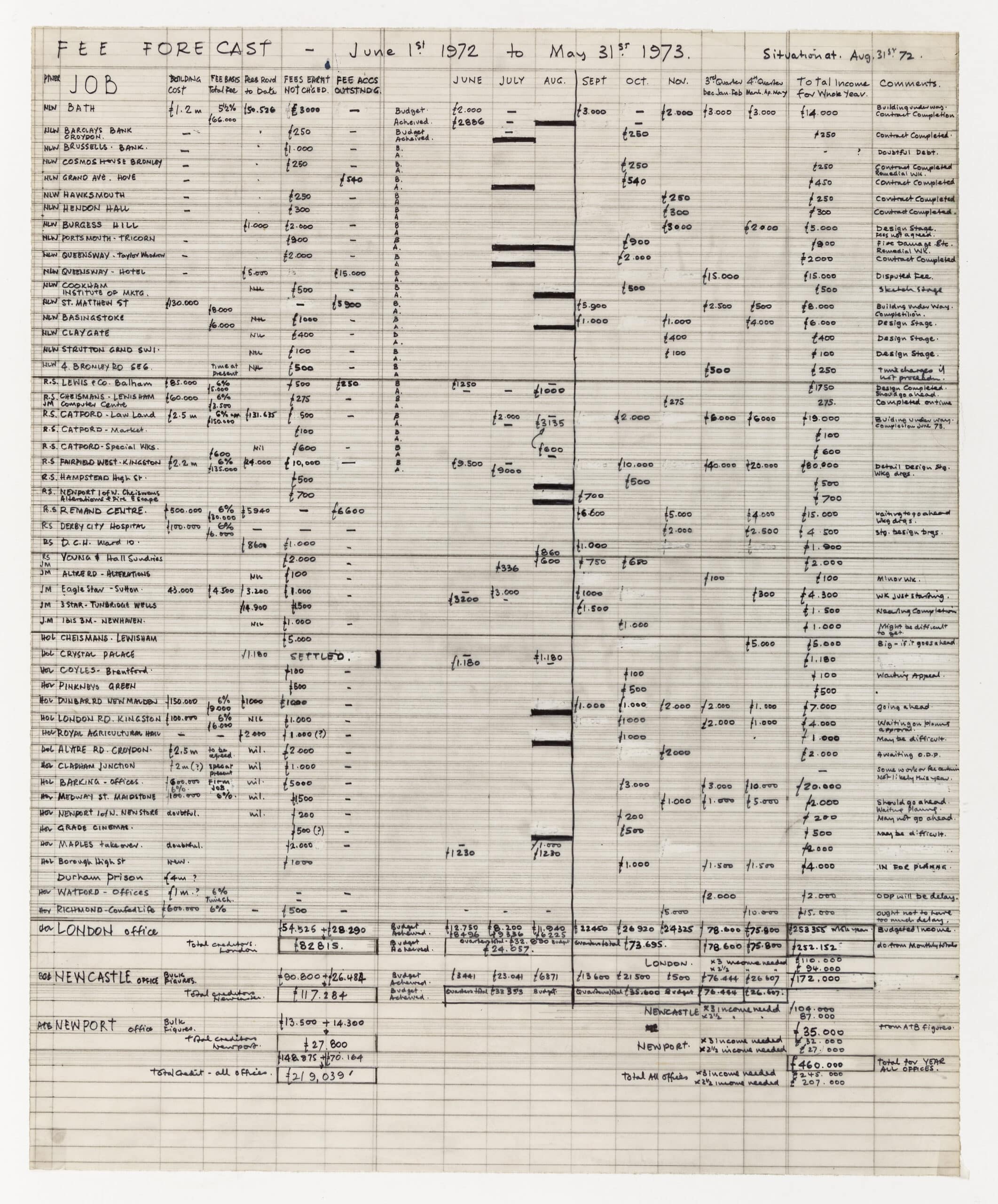

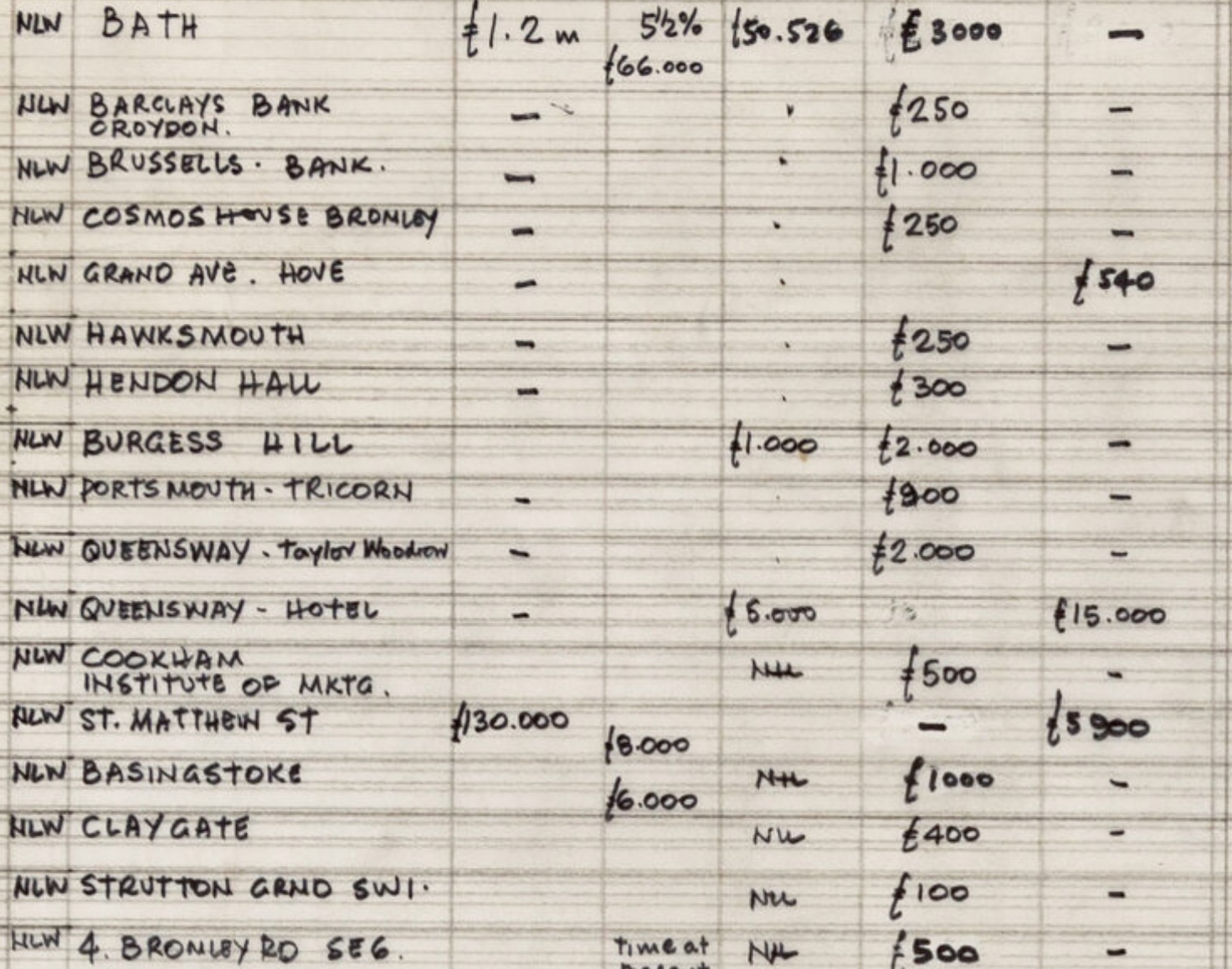

The practice’s accountant, Ron Bradley, who has been accountant to Owen Luder since the early days of the late 1950s, attends part of most partners meetings so that he is immediately available for any expert accountancy advice. Detailed monthly income and expenditure figures are produced, with budgets of future outgoings and fee income. These are related to ongoing monthly, quarterly and annual budgets, and actual progress is always checked against what had been budgeted – expected or unexpected. Again, this is an inbuilt discipline which ensures that partners think ahead all the time. Forecasting is never an accurate science, but the more facts that are available the less has to be left to guesswork.